A lot of things have changed in the banking and financial segment since the time I joined it 15 years ago. Technology and innovation created multiple disruptive opportunities and will continue to do so. Business models have undergone change time and again to survive. Twenty-one new banking licenses are issued to undertake financial inclusion at a scale never imagined before.

However, the most noticeable change is the kind of capital used to fuel new age as well as brick and mortar businesses. There is no prize for guessing which is the most popular financing product today! Yes, it is EQUITY!

Today, businesses are raising equity like never before. For many, getting funded by a mainstream venture capital fund or a private equity fund is the epitome of their business success. The PR that follows is given more weightage than the MIS that follows post the investment.

The key question which many companies fail to ask – is this the right kind of capital for us? If NOT, what is the right kind of capital? If YES, are we prepared?

One of the key aspects of growth for any company is to match the nature of capital to the growth rate of the company and more importantly to determine the preparedness of the company. Some of the key questions the management should ask themselves before availing a particular capital product –

1) Is the market ready for our product and what’s going to be our growth rate?

2) When will we hit a plateau in our growth rates? (in what timeframe)

3) Do we have adequate systems and processes to absorb that particular nature of capital and use if efficiently

4) Is our team geared up to meet the challenges of growth?

5) Are we smart in our balance sheet planning and maximizing Return on Equity?

One key consideration in this exercise is to ascertain if right kind of capital is available. Thus there are two key considerations – suitability and availability. I believe in India the availability factor plays a key role as compared to suitability.

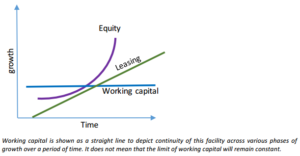

The issue that Indian companies face today is lack of innovative financing productsin the ecosystem. Ideally the market should offer bouquet of products and the companies should be able to choose the one suitable to the nature of its business and its growth rate. Unfortunately, India does not offer such a luxury and development on this front is still a distant dream. Strictly speaking, there are only three products available in India on a large scale – Equity, term loan and working capital Loan. There are many sub products within term loan and working capital but its more form over substance. To add to this agony, term loans and working capital loans come with so many stringent covenants and conditions that most of the new age businesses are unable to avail it. Thus many avail Equity not out of choice but out of compulsion.

Ideally, every company needs to measure and estimate its realistic growth rate and then decide on the kind of capital which will fund it. I remember one quote from a renowned private equity investor “equity is a rocket fuel. Do not infuse if your business is a rickshaw”!! This could be one of the key reasons many startups fail because they try to accelerate their business to meet the expectations of equity funding but the inherent nature of their business does not allow that. Many startups fail to create a balanced capital structure on its balance sheet. Many startups do not wish to see beyond equity, thanks to the glamour quotient attached to it.

So the next logical question is – how to select nature of capital for various initiatives?

Equity is ideal when you have rapid growth coming in and heavy investment is required in marketing, branding, people and organization built up. No form of debt can substitute this. The cost of equity is the highest. The most absurd argument I have heard is “I am raising equity because I don’t need to pay any interest !!”

Another financial product which is growing in India is venture debt. There are couple of innovative venture debt funds in India providing quasi equity capital (more a bridge finance between two equity rounds) to mainly fund the cash burn (operating loss).

It will be ideal to fund routine working capital expenses through a decent working capital or a cash credit line from a bank or NBFC (Non Banking Finance Company).

Interestingly, asset creation can be funded by two products, one is the old time term loan and one is a highly innovative product called operating lease. Term loan with longer tenures are suitable for projects with gestation period and slow built up. Since the tenure is longer, adequate time is available to meet the debt obligation.

Leasing, specially operating lease can be very effective for funding cash generating assets – assets which start making money immediately for the company. E.g. medical equipment for doctors, hospitals etc. If the asset turn ratio of the business is high, leasing is the best product since a company can grow linearly by availing leasing after defined periodic intervals. E.g. open a new outlet or center by leasing, wait for 6 months and avail leasing to open the next outlet. The profits of earlier outlet or center along with leasing will fund the next one!

A good and intelligent combination of various products can potentially minimize your weighted average cost of capital (WACC) and maximise your Return on Equity (ROE).

Thus any company should not paint all growth initiatives with the colour of just one form of capital. It should carry out realistic assessment of its requirement and create an intelligent capital structure which will not only fund the business effectively but will also create long term sustainable advantage of that business.

About The Author:

Shrirang is a founder and CEO of ORIGA Leasing one of the first FinTech asset leasing companies for high growth oriented companies with philosophy of access to finance. ORIGA Leasing is instrumental in providing highly innovative asset leasing solutions to in the sectors such as healthcare, manufacturing, sanitation, water and services. It is one of the first leasing companies to extensively leverage technology for providing complete Asset Life Cycle Management (ALCM) to its clients.

Prior to ORIGA, Shrirang has 15 years of experience in areas of investment banking, fund raising, business advisory and structuring. He was part of niche teams at Clearwater Capital Partners, ANZ Investment Bank and PwC. He also had his own investment bank. Shrirang is a Chartered Accountant by qualification and graduate in commerce from Mumbai University.

Shrirang Tambe | Founder & CEO | ORIGA |

shrirang.tambe@origaleasing.com | India Mobile: M: +9198216 19019 | www.origaleasing.com

Mumbai Office: Office No B/9&10, ground floor, Navkar Chambers, Marol Naka, Andheri-Kurla Road, Andheri (East), Mumbai, 400059.